9 most user-friendly budgeting apps for event planners

We round-up the best budgeting apps and software for event creators – spanning from super simple personal budgeting apps to more robust software suitable for event teams. Let's go!

Budgeting is key for any event, no matter how big or small it is. It’s the thing that keeps all of those spinning plates, well… spinning. Staff payroll, travel costs, venue hire, equipment, insurance, contingency costs – the list goes on. And things can soon get out of control when you don’t have a clear view of your event’s finances.

Thankfully, there are plenty of user-friendly (life-saving?) apps that can turn all of this headache-inducing stuff into a walk in the park.

In this guide, we round up the best budgeting apps for event planners, focusing specifically on apps that offer an accessible approach to money-management.

Best budgeting apps for event planners – 1 minute summary

- Joi: Best for multi-event planners needing real-time tracking and forecasting.

- QuickBooks Online: Great for small business event planners needing project-based accounting.

- YNAB: Great for solo event planners who want to assign every pound and stick to a budget.

- Zoho Expense: Best for small teams running recurring events.

- Quicken: A good fit for freelancers or solo event planners who want combined personal + event budgets.

- Snoop: Free option for solo event planners seeking insights and savings tips on spending.

- FreshBooks: Ideal for service-based event planners who need invoicing and project tracking.

- Emma: Simple visual dashboards for solo event planners managing cash flow.

- Pleo: Perfect for event teams needing spend management and approval workflows.

What to look for in a budgeting app

When choosing a budgeting app as an event creator, look for ease of use and clarity. You definitely don’t want a tool that makes you feel you need an accounting qualification 😰.

Think about whether you need multi-event tracking, vendor management, or forecasting tools, especially if you run recurring or large events. Apps that allow you to track expenses in real time, generate reports, and compare actual costs vs. budget projections will save you hours of stress and spreadsheet work. Phew.

Joi

Joi is a budgeting tool built specifically for event planners, designed to keep track of all costs, vendors, and revenue in real time.

Whether you’re a festival organizer juggling multiple line-items like artists, catering, and equipment, or a corporate events organizer running conferences across the year, Joi helps you see every expense and forecast your budget with ease.

Key features

Real-time cost tracking: Monitor all expenses, vendors, and revenue as they happen to avoid surprises.

Customizable templates: Quickly set up budgets for recurring events or similar event types.

Vendor management: Track quotes, invoices, and payments from multiple suppliers in one place.

Multi-currency support: Easily handle expenses and revenue in different currencies for international events.

Forecasting tools: Compare projected budgets versus actual spending to keep events on track financially.

Pricing

Joi’s pricing is based on how many active events you have at any one time. It doesn’t matter what size your events are; pricing is based on the number of events only.

Pricing starts at £30/month for 10 active events.

Pros

- Built specifically for event planners – no clutter from unrelated features

- Intuitive interface, easy to pick up

- Powerful forecasting helps prevent budget blowouts

Cons

- Less suited for full small-business accounting

- More expensive than simple personal budgeting apps

- Pricing and structure mean it's probably overkill for very small or one-off events

QuickBooks Online

QuickBooks Online is a robust accounting platform that goes beyond simple budgeting, offering tools for income tracking, expense management, and project-based reporting.

A solo planner or agency managing multiple events can allocate budgets per project, track profitability, and even manage taxes. For example, a music festival organizer could track spending per stage or per day, ensuring each component of the event stays within budget.

Key features

Project-based tracking: Allocate budgets per event or project for accurate profitability tracking.

Automated expense categorisation: Let QuickBooks automatically sort expenses to save time.

Bank & credit card integration: Sync accounts for up-to-date financial information without manual entry.

Budget vs. actual reporting: Quickly compare planned budgets with real spending to spot issues.

Tax & compliance tools: Keep tax-ready records and reports for easier end-of-year filing.

Pricing

Quickbooks online has a range of different plans, but only the two pricier plans include the platform’s budgeting feature:

- Simple start: £16/month – limited features and no budgeting features.

- Essentials: £38/month – limited features and no budgeting features.

- Plus: £56/month – more features + full access to budgeting tools.

- Advanced: £123/month – advanced features + full access to budgeting tools.

Pros

- Robust accounting and budgeting tools

- Highly trusted and widely used

- Scalable for growing event businesses

Cons

- Slightly more complex interface for beginners

- May include features unnecessary for very small events

YNAB (You Need A Budget)

YNAB is a personal budgeting app that helps users give every pound a “job,” encouraging proactive and intentional spending. It’s technically designed for personal finance, but there’s no reason you can’t use it as an event planner. If you run smaller, less complex events, this app can easily be used to manage tight budgets and control your cash flow. For example, a local fan convention organizer could allocate funds to venue hire, marketing, and actor fees to help make sure each event is profitable.

Key features

Zero-based budgeting: Allocate every pound to a specific purpose, so all income is accounted for.

Goal tracking: Set savings or spending goals for specific events or projects.

Real-time reporting: See exactly where your money is going and how it affects your budget.

Multi-device sync: Track budgets from your phone, tablet, or computer seamlessly.

Spending alerts: Stay aware of overspending before it becomes a problem.

Pricing

YNAB is subscription-based and comes with a free trial:

- Monthly plan: £14/month – full budgeting features, multi-device sync

- Annual plan: £98/year – full budgeting features, multi-device sync

Pros

- Highly intuitive and user-friendly interface

- Encourages proactive budgeting habits

- Flexible enough for both personal and small event planning

Cons

- Not specifically designed for multi-event tracking or team use

- No invoicing or accounting integrations

Zoho Expense

Zoho Expense is a smart expense and budget management tool that helps teams track spending in real time, manage approvals, and generate budget reports. Small event companies or teams running recurring events can use it to monitor travel, catering, or supplier costs, so all expenses are captured and budgets are maintained across multiple events.

Key features

Automated expense capture: Snap receipts or import transactions to reduce manual entry.

Multi-currency & multi-user support: Track team spending across different countries and currencies.

Custom budget rules & alerts: Set limits and receive notifications to prevent overspending.

Approval workflows: Streamline team expense approvals with automated routing.

Accounting integrations: Connect seamlessly with platforms like QuickBooks or Xero.

Pricing

Zoho Expense offers tiered plans depending on team size and features:

- Standard: £5/user/month – core expense tracking and receipt capture

- Professional: £8/user/month – budgeting, reporting, and multi-user approval workflows

- Premium: £12/user/month – advanced reporting, analytics, and integrations

Pros

- Strong multi-user features for team collaboration

- Integrates well with existing accounting software

- Automated expense management saves time

Cons

- Some features may be more than a solo planner needs

- Interface can be busy for new users

Quicken

Quicken is a versatile finance management app that combines personal and business budgeting in one platform. Solo planners or freelancers can use it to manage both event-related costs and personal finances in one place. For example, a freelancer running pop-up workshops can keep track of venue fees, marketing spend, and ticket income, while also monitoring household expenses, all within a single dashboard.

Key features

Personal + business modes: Switch between personal and event-related finances easily.

Bill tracking & alerts: Receive reminders and track recurring bills for smooth cash flow.

Cash flow & net worth reporting: Understand your financial health at a glance.

Investment & account tracking: Monitor investments or business accounts alongside your event budgets.

Cloud sync across devices: Access budgets and reports anywhere with automatic syncing.

Pricing

Quicken’s plans are annual and vary by feature set:

- Starter: £34.99/year – basic personal & business budgeting, bill tracking

- Deluxe: £49.99/year – investment tracking, cash flow analysis, enhanced reporting

- Premier: £74.99/year – advanced reporting, priority support, full budgeting capabilities

Pros

- Combines personal and business budgets

- Simple interface, easy for beginners

- Strong reporting capabilities

Cons

- Less specialised for multi-event planning

- Desktop-heavy, cloud features limited

Snoop

Snoop is a personal finance app designed to give users insight into spending and opportunities to save money. Again, this app is designed for personal use but it can also be really handy for solo event creators or small planners who want to optimise costs and monitor cash flow.

For example, a solo nightlife planner could receive alerts about cheaper supplier options or cashback opportunities.

Key features

Automated expense analysis: Categorises spending and highlights patterns for smarter decisions.

Savings suggestions: Provides personalised tips to reduce unnecessary costs.

Real-time alerts: Notifies users of upcoming bills, high spending, or potential savings.

Goal setting: Helps allocate funds for upcoming events or projects.

Secure bank integration: Links accounts safely for a complete view of finances.

Pricing

Snoop is free to download and use. There are no paid tiers; all features, including bank linking and alerts, are included.

Pros

- Simple, intuitive interface for solo planners or small businesses

- Helps identify cost-saving opportunities

- Real-time alerts keep spending under control

Cons

- Not designed for multi-event budgeting or team collaboration

- Limited reporting or invoicing capabilities

FreshBooks

FreshBooks is an intuitive accounting platform that simplifies expense tracking, invoicing, and project-based budgeting. Small business event planners can use it to monitor expenses, and see profitability at a glance. Ideal for hosts of networking events, class instructors, and workshop organizers.

Key features

Automated expense tracking: Link bank accounts and credit cards to automatically record costs.

Project-based tracking: Monitor budgets and profitability for each event or client project.

Invoicing & payments: Send invoices and receive payments quickly within the platform.

Multi-device cloud access: Track finances from any device, anywhere.

Reporting & insights: Generate simple reports to understand profitability and cash flow.

Pricing

FreshBooks has tiered monthly plans depending on the number of clients and features:

- Lite: £6/month – basic expense tracking and invoicing for up to 5 clients

- Plus: £10/month – multiple clients, project tracking, recurring invoices

- Premium: £20/month – team access, advanced reporting and workflows

Pros

- Extremely user-friendly, minimal learning curve

- Great for invoicing and expense tracking combined

- Cloud-based, accessible anywhere

Cons

- Not built specifically for multi-event tracking

- Lacks some advanced forecasting features

Emma

Emma is another personal finance app that can help solo planners manage cash flow, track expenses, and maintain financial visibility. A yoga teacher running weekend classes or a small creative workshop host can use Emma to track income, monitor spending categories, and make sure profits stay healthy without getting bogged down in complex accounting systems.

Key features

Automated expense categorisation: See where money is going across different spending categories.

Visual dashboards: Quickly spot trends, overspending, or areas to cut costs.

Bill & subscription tracking: Keep track of recurring costs like software, venue rentals, or services.

Multi-account support: Manage multiple accounts in one interface to separate event vs. personal finances.

Notifications for overspending: Receive alerts to stay on budget and avoid surprises.

Pricing

Emma offers both free and paid options:

- Free: £0 – core budgeting and transaction tracking

- Pro: £4.99/month – advanced insights, subscription monitoring, savings tips

- Premium: £9.99/month – full reporting, enhanced notifications, multiple account management

Pros

- Highly visual, easy-to-read dashboards

- Quick setup and low learning curve

- Helps maintain financial discipline for small events

Cons

- Limited multi-event features

- Not designed for team collaboration

Pleo

Pleo is a team-focused expense and spending management tool that gives businesses visibility and control over budgets. Event teams can provide staff with prepaid cards, track spending in real time, and set budget limits for each project. For example, you could use Pleo to allocate a fixed catering budget to each coordinator or give volunteers a card for last-minute supplies, with every purchase tracked instantly. Nice.

Key features

Prepaid company cards: Give team members spending cards tied to specific budgets.

Real-time expense tracking: Monitor every transaction as it happens across your team.

Budget management per project: Assign budgets to events, departments, or teams for control.

Automated receipt capture: Employees snap receipts and upload them instantly for approval.

Accounting integrations: Sync all spending data with accounting software for streamlined reporting.

Pricing

Pleo is priced per user per month, designed for teams:

- Starter: £5/user/month – core expense tracking and prepaid company cards

- Premium: £9/user/month – budget controls, multi-event tracking, team workflows

- Enterprise: Custom pricing – advanced reporting, integrations, dedicated support

Pros

- Excellent for teams and collaborative budgeting

- Streamlines approvals and receipts

- Easy to integrate with accounting software

Cons

- Less relevant for solo planners

- Pricing can add up with larger teams

💸 The most budget-friendly ticketing platform around

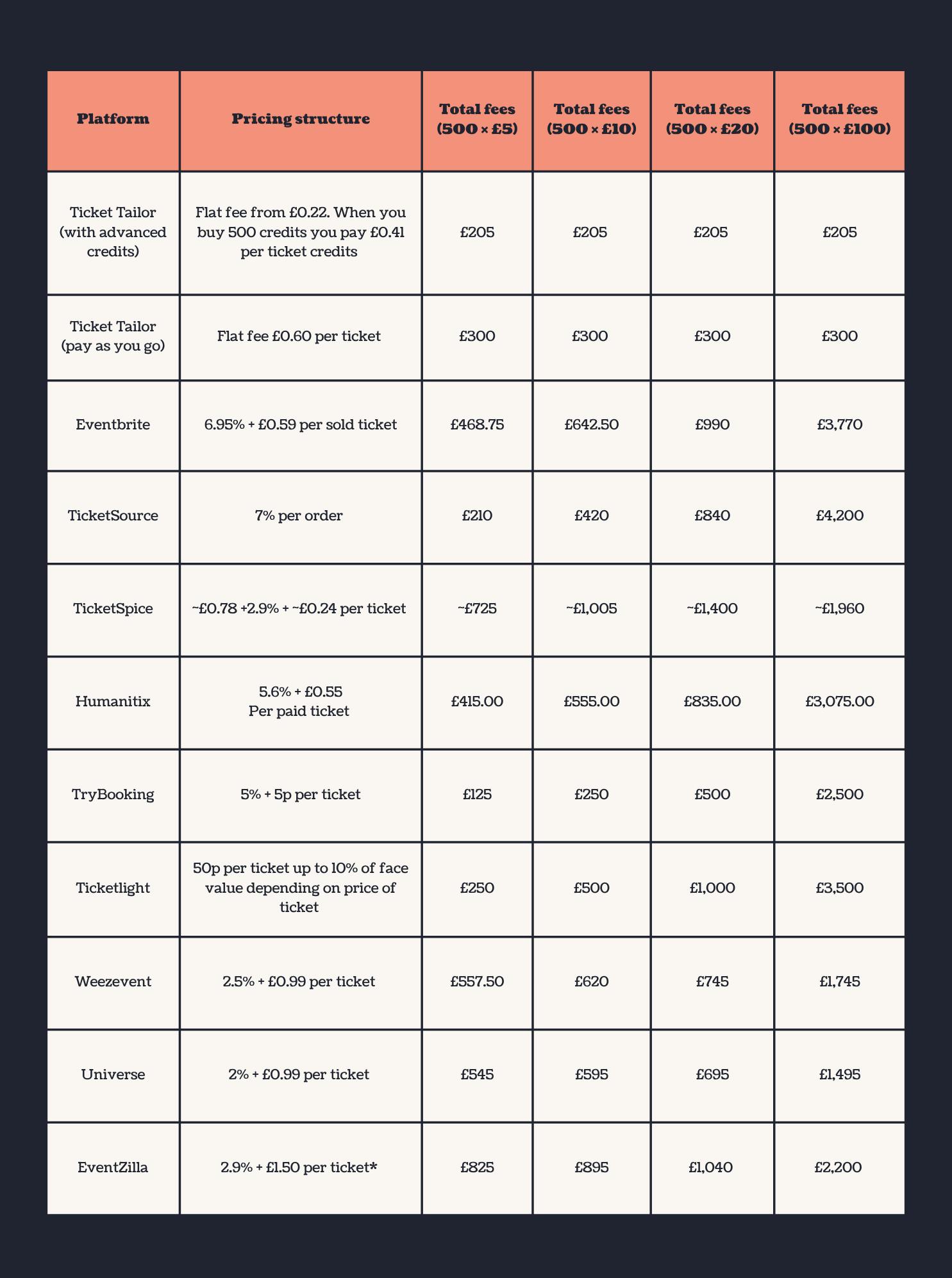

Sticking to your event budget can be challenging, but it’s made a whole lot easier when you’re not overspending on areas you don’t need to. Case in point: Ticket Tailor is the cheapest ticketing platform in the market, with simple flat-fee pricing that can save event creators thousands when they switch from major players like Eventbrite. We’re also a much cheaper alternative to TicketLeap, TicketSource, and TicketSpice Woohoo! 🎉